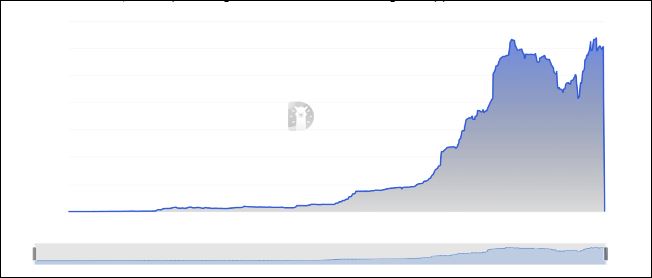

In the age of digital transformation, the concept of Real-World Assets (RWAs) has gained significant traction. According to DEFI data aggregator Defillama, while TVL(total value locked) in the blockchain ecosystem has remained in a consolidation phase around $40-50Bn since 2022, while TVL in RWA category has skyrocketed from a few million dollars in 2022 to $6.26Bn in 2024. The growth and adoption that Tokenized Real world assets have shown in the past 2 years has been nothing short of phenomenal and shows no signs of stopping.

This shows growing adoption of tokenized RWAs not just from crypto-native investors but also new investors who are investing on-chain through RWA based protocols fueling the mass adoption of blockchain technology.

What are Tokenized RWAs?

Tokenized RWAs represent physical assets tokenized on a blockchain as digital tokens, enabling secure, transparent, and efficient trading, ownership, and management of the underlying assets.

This concept bridges the gap between traditional finance and decentralized technologies. Tokenized RWAs offer investors many benefits like diversification, fractionalization, faster settlement times, while providing access to a broader range of opportunities.

A graph of TVL in RWA category from 2022 to APR 2024. Source: Defillama.

Key Takeaways:

- Tokenized RWAs are physical assets tokenized on a blockchain, enabling digital representation and decentralized management.

- RWAs bridge traditional finance and the decentralized world, offering increased liquidity, transparency, and access to new investment opportunities.

- Key risks include regulatory uncertainty, security vulnerabilities in smart contracts, liquidity constraints and oracle problems.

- Smart contracts automate and secure RWA transactions, reducing the need for intermediaries and increasing efficiency.

- Companies like Intelisync offer scalable smart contract development services to help businesses manage RWAs on blockchain platforms.

- To start investing in RWAs, research reputable platforms, understand the risks, and ensure compliance with regulations. Conduct thorough due diligence before investing.

RWAs in the blockchain environment refer to digital tokens that reflect actual and traditional financial assets. This covers currency, commodities, stocks, and bonds.

RWAs enable these assets to find their place in the Decentralized Finance (DeFi) ecosystem, boosting access to previously inaccessible financial tools and opening up new application vistas.

In this post, we’ll explore what tokenized RWAs are, how they form, and how Intelisync can offer a complete solution to meet the requirements of tokenized assets.

Why Are RWAs Important in Crypto Space?

The cryptocurrency industry has evolved rapidly, growing from a niche interest into a significant global financial market force. Today, it includes a wide array of digital currencies, platforms, and technologies, all built on the foundation of blockchain technology.

While cryptocurrencies themselves have experienced tremendous growth in their market capitalization as an asset class, they’re still miniscule and insignificant when compared to traditional financial securities and other physical assets.

The entire digital assets market is less than $3Tn while the global financial markets are more than $109Tn as reported by Statista.

This shows digital technology still has a lot of growth potential in it. The technology, distributed ledgers created for cryptocurrencies can offer real benefits to traditional financial instruments and real world assets. These assets represent the next big growth engine for digital blockchain space.

Real world assets & digital ecosystems will benefit from each other for several reasons:

- Tokenization of real-world assets provides greater flexibility in buying, selling, or trading, enhancing liquidity in markets that are traditionally illiquid and also provide potential gains in efficiency and capital requirements.

- Current high interest rate environment is exposing the cost capital inefficiencies. The cost of inefficient clearing, trading & financing of activities has gone up exponentially in recent years, with fewer intermediaries involved, tokenized RWAs can lower transaction costs and speed up settlements, making the process more efficient for tradFI players like banks, funds as well as investors and asset holders.

- RWAs play a crucial role in DeFi by serving as sustainable, valuable collateral for lending, staking, and other financial services, thereby providing real, sustainable yields to DEFI investors and expanding the range of applications for DEFI protocols.

- Blockchain technology provides a transparent and immutable ledger, allowing for clear tracking of asset ownership and transactions. This transparency helps to reduce fraud and increase trust among participants.

Types of RWAs in Crypto

RWAs encompass a variety of assets, including real estate, commodities, precious metals, and even fine art. Tokenizing these assets allows for fractional ownership, enabling smaller investors to participate in markets previously out of reach. This approach brings traditional assets into the digital world, offering new opportunities for investment and decentralized finance.

Here are the main types of RWAs in crypto:

- Real Estate: This is one of the most common types of RWAs. Tokenized real estate allows investors to own fractions of properties or invest in real estate projects, offering a more accessible and liquid way to engage in the real estate market.

- Commodities: Commodities like gold, silver, and oil can be tokenized to create digital representations that can be traded on the blockchain. This approach provides investors with an easier way to invest in and trade commodities.

- Precious Metals: Tokenized gold, silver, platinum, and other precious metals allow investors to buy, sell, or hold these assets digitally. The blockchain provides a secure and transparent method for tracking ownership.

- Art and Collectibles: Fine art, rare collectibles, and other unique items can be tokenized to create digital assets. This enables fractional ownership and easier trading, opening the art market to a broader range of investors.

- Intellectual Property: Intellectual property (IP) assets, like patents, copyrights, and trademarks, can be tokenized. This allows for easier licensing, trading, or investment in IP-based ventures.

- Agricultural Products: Crops and livestock can also be tokenized, offering a way for investors to participate in the agricultural sector. This approach can improve transparency and efficiency in the supply chain.

- Debt Instruments: Bonds, mortgages, and other debt instruments can be tokenized, enabling a more accessible way to trade and invest in these financial products. Tokenization can also streamline the issuance and settlement process.

- Infrastructure Projects: Large-scale infrastructure projects, such as energy production facilities or transportation networks, can be tokenized. This enables fractional ownership and investment in these high-value projects.

Read our latest post about Decentralized Autonomous Organizations(DAO) to learn how Intelisync uses cutting-edge blockchain development solutions tailored to your enterprise needs.

Why is tokenization of these products beneficial?

Tokenization of these TradFI instruments and RWAs represents many potential benefits like creation of new markets for presently illiquid assets like real estate, collectibles, agriculture etc while enabling benefits like fractionalization.

For asset classes that already enjoy a liquid market in traditional finance like financial securities, tokenization offers the next big push in efficiency, transaction speeds, faster settlement times, cost reduction, etc.

The Future of RWAs in the Crypto World

Future trends and developments in RWA in DeFi and crypto are expected to significantly grow and evolve in the coming years, providing new opportunities and benefits to both asset owners and investors.

Many recognized institutions project that the market capitalization and TAM (total addressable markets) for tokenized assets will range from $14-16 trillion, according to consultants like BCG and McKinsey. Venture funds like Outlier Ventures estimate the TAM for tokenized assets to reach $20 trillion by 2030.

Here are some trends to watch:

Interoperability Across Blockchains:

Interoperability between different blockchains and platforms will play a crucial role in the success of RWAs. Ensuring seamless communication between ecosystems will drive innovation and expand the possibilities for tokenized assets. This will allow tokenized assets to move seamlessly across various platforms, increasing their utility and accessibility. Interoperability can also foster innovation by encouraging collaboration among different blockchain communities.

Regulation:

The tokenization of real-world assets will drive collaboration between blockchain developers and regulatory authorities. As regulations for crypto become clearer, RWAs will likely comply with existing frameworks, increasing confidence and adoption among traditional investors. This increased regulation can lead to greater investor confidence and broader adoption.

Improved Security and Transparency:

As the use of RWAs grows, so will the focus on security and transparency. Advances in smart contract technology and blockchain security protocols will help protect against risks and vulnerabilities, ensuring the safety of tokenized assets.

Ready to unlock the potential of RWAs? Reach out to Intelisync and discover innovative smart contract solutions.

Challenges and Risks with RWAs in Crypto

While RWAs have immense potential, they also present challenges. Regulatory compliance is a major concern. Understanding these issues is essential for anyone involved in the tokenization of RWAs, whether from an investment, operational, or regulatory perspective. Let’s explore the key challenges and risks associated with RWAs in the crypto space.

Regulatory Uncertainty:

One of the most significant challenges facing RWAs is the lack of clear regulatory frameworks. Different countries and regions have varying rules regarding tokenization, ownership, and the legality of digital assets. This regulatory uncertainty can pose risks to investors and businesses, making it challenging to ensure compliance and navigate the legal landscape.

Security Risks:

Smart contracts tokenize RWAs, which introduces security risks because potential vulnerabilities in smart contracts can be exploited, potentially resulting in the loss or theft of assets.

Robust security measures must address cybersecurity threats, such as hacking or theft, to mitigate these concerns effectively.

Custody and asset management:

The tokenization of RWAs relies heavily on secure and trustworthy custody and management of both physical and digital assets, as well as alignment of the rights and obligations of token holders and asset owners. RWA may present a variety of technological and operational risks, including the security and dependability of blockchain platforms, the correctness and validity of asset data and documents, and the management and preservation of physical assets.

Liquidity Constraints:

Although RWAs are designed to increase liquidity, certain tokenized assets might not achieve sufficient trading volume. This illiquidity can impact the ability to buy or sell tokens, especially for larger assets like real estate.

Oracle Problem:

As smart contracts conduct transactions related to physical assets, they need to have data and accurate information about these markets and underlying products which comes through data oracles. These trusted oracles could be hacked, disseminating inaccurate data over to a smart contract leadingto unauthorized transactions and loss of investor capital.

Decentralised Finance (DeFi) and RWAs

Decentralized Finance (DeFi) is a transformative sector within the cryptocurrency space that uses blockchain technology to recreate and innovate traditional financial services. Real-World Assets (RWAs) represent a bridge between the digital realm of DeFi and tangible physical assets.

Integration of RWA in DeFi

DeFi operates on blockchain technology, enabling financial transactions through smart contracts. RWAs bring physical assets into this digital ecosystem, allowing users to engage with traditional assets like real estate, commodities, and more. By tokenizing these assets, DeFi platforms can offer innovative financial products backed by tangible assets.

RWA can provide portfolio diversity and long-term return while also capitalizing on DeFi’s tremendous potential.

Traditionally, DeFi has been primarily concerned with crypto-native assets, but the addition of RWAs represents a significant shift. This convergence allows DeFi to access a greater range of assets, such as bonds, real estate, commodities, and even intellectual property, broadening its reach and appeal.

DeFi also provides exposure to a diverse range of assets, decreasing reliance on the market for cryptocurrency. Diversification might potentially reduce risk and provide more consistent returns.

RWAs in DeFi can benefit from smart contract automation, which streamlines operations such as asset transfer, verification, and yield distribution, lowering operational costs while enhancing efficiency.

DeFi Applications for Real World Assets

Asset-Backed Lending and Borrowing:

DeFi platforms that support asset-backed lending allow users to borrow cryptocurrency by using RWAs as collateral. For example, tokenized real estate, commodities, or even fine art can be used to secure loans. This approach offers flexibility and reduces the need for traditional intermediaries like banks, enabling users to access liquidity without selling their assets.

Yield Farming with RWAs:

Yield farming, a popular DeFi practice, involves providing liquidity to a platform in exchange for rewards. RWAs can be used to create innovative yield farming opportunities. For example, a platform might allow users to stake tokens backed by RWAs, earning interest or additional tokens as rewards. This approach provides an alternative to traditional yield farming with digital-only assets.

Asset-backed Stablecoins:

Some DeFi projects issue stablecoins backed by RWAs.These stablecoins can provide a more reliable value proposition since they tie to tangible assets. By leveraging the stability and intrinsic value of RWAs, these stablecoins provide a reliable and transparent medium of exchange, enabling a wide range of DeFi applications.

Their reduced volatility, increased trust, new use cases, cross-border capabilities, and diversified reserves make them a valuable asset within the DeFi ecosystem.

Smart Contract Development: Intelisync

Real-World Assets (RWAs) are transforming the way businesses interact with tangible assets in the digital age, creating new opportunities for automation and efficiency.

At Intelisync, we specialize in providing comprehensive smart contract development services that help startups and small businesses leverage blockchain technology to automate agreements, streamline processes, and securely manage RWAs

Our scalable smart contract development services enable you to automate the management of RWAs on blockchain platforms.

By utilizing dynamic technologies, we ensure that your smart contracts are efficient, reliable, and capable of handling the complexities of RWAs, whether it’s real estate, commodities, or other tangible assets.

Real-World Assets (RWAs) are opening new doors for startups and small businesses, offering a way to digitize and automate the management of tangible assets.

Intelisync’s smart contract development services are designed to help you take full advantage of these opportunities. With scalable smart contracts, automated contract management, and decentralized trust, we provide the tools you need to navigate the evolving landscape of RWAs.

Contact us to learn how our expertise can help you streamline your processes and embrace the future of asset management.

Interested in integrating RWAs into DeFi? Contact Intelisync to find out how our smart contract solutions can help.

Conclusion:

Real-World Assets (RWAs) represent a significant leap forward in bridging the gap between traditional finance and the decentralized world of crypto.

By tokenizing tangible assets like real estate, commodities, and intellectual property, RWAs bring a new level of flexibility, transparency, and accessibility to investors and businesses. This innovation holds the potential to transform how we view asset ownership and participation in financial markets.

To explore the opportunities that RWAs offer, consider engaging with experts like Intelisync. They can provide comprehensive smart contract solutions and guide you through the complexities of tokenization.

By partnering with a trusted provider, you can harness the power of RWAs to diversify your portfolio, streamline asset management, and access innovative DeFi applications.

Real-World Assets are reshaping the crypto landscape, offering new ways to engage with the traditional financial world.

As we continue to see advancements in blockchain technology and regulatory clarity, the future looks promising for RWAs and their role in the digital economy.

Frequently Asked Questions:

What Does RWA Mean in Crypto?

Real-World Assets (RWAs) are tangible assets that blockchain technology tokenizes or digitally represents. This process connects traditional assets with the crypto world. Which allow investors to trade, hold, and utilize these assets in a digital environment.

How Is RWA Different from Traditional Assets?

Traditional assets exist in the physical world and are often subject to complex regulations and intermediaries. RWAs tokenize these assets on a blockchain, providing increased flexibility, liquidity, and the potential for fractional ownership.

What Are the Benefits of Investing in RWAs?

Investing in RWAs offers several advantages, including greater liquidity, reduced transaction costs. Also the ability to diversify into a broader range of assets. RWAs also enable fractional ownership, allowing smaller investors to participate in markets like real estate, commodities, and more.

What Risks Are Associated with RWAs?

RWAs carry certain risks, such as regulatory compliance, security vulnerabilities in smart contracts,oracle problems and potential liquidity constraints. Additionally, custody and valuation issues can pose challenges for investors in RWAs.

What Role Do Smart Contracts Play in RWA Projects?

Smart contracts are a fundamental component of RWA projects. They enable automated transactions, enforce ownership rights, and ensure that tokenized assets operate as intended on the blockchain. Smart contracts reduce the need for intermediaries and increase the efficiency of RWA transactions.

Curious about Real-World Assets in crypto? Connect with Intelisync to discover the benefits of tokenization.

One thought on “RWA assets explained : A $20Tn opportunity?”